If you don’t have an efficient way to manage your fixed assets, you’ll constantly get pulled away from more strategic work. Bloomberg Tax Fixed Assets software is a cloud-based fixed assets subledger that automatically and accurately calculates depreciation so you can maximize tax savings.

With asset depreciation software that is fully integrated with the rest of your ecosystem, you can automate time-intensive, complex processes.

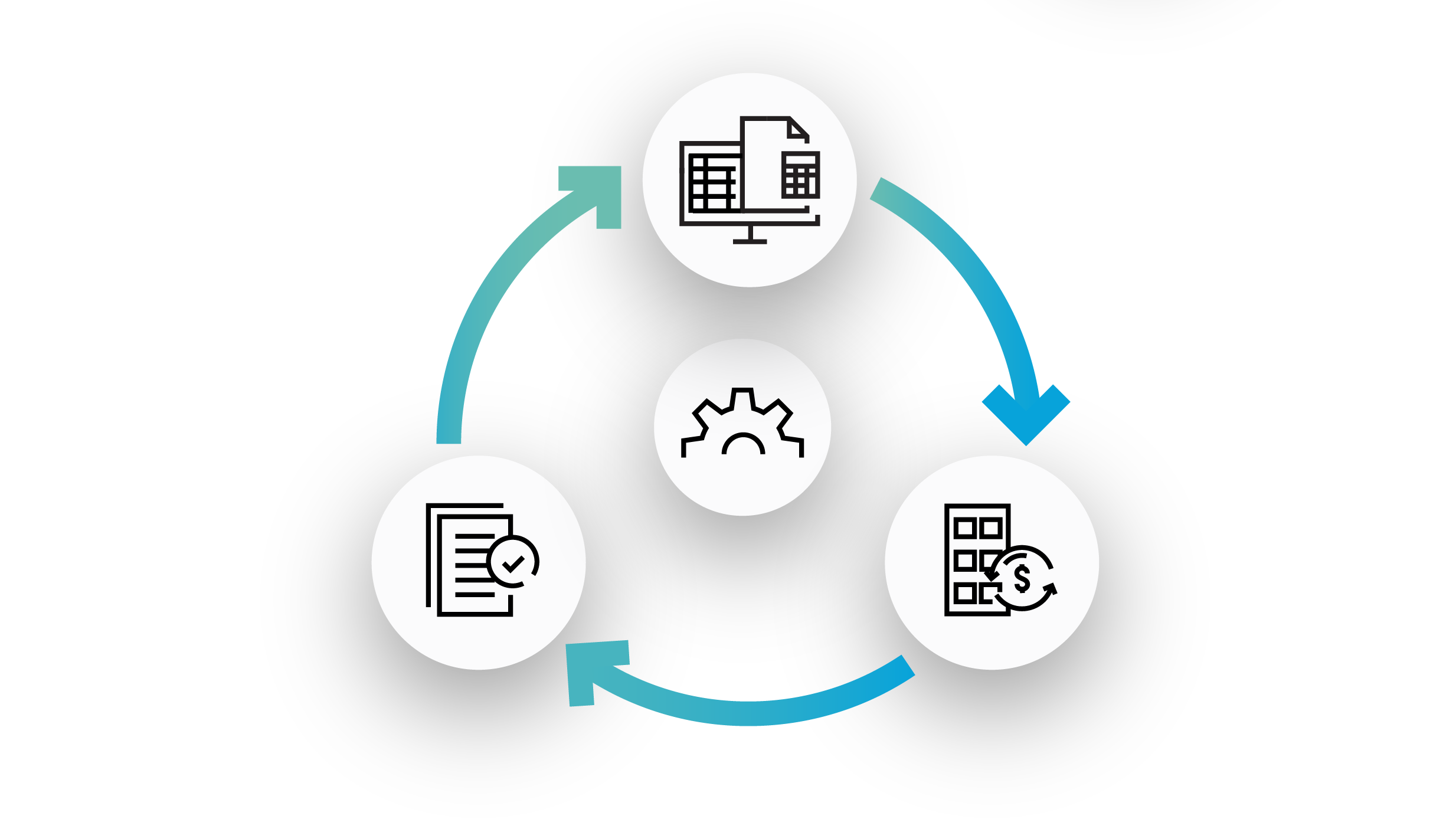

Remove the chance of manual errors and know you’re always accurate with automated depreciation calculations based on built-in, up-to-date tax laws.

Manage your PP&E to move beyond compliance and effectively plan strategies that help your organization see better tax savings from your fixed assets.

Bloomberg Tax Fixed Assets is a powerful solution to the time-consuming issues tax professionals have dealt with for far too long.

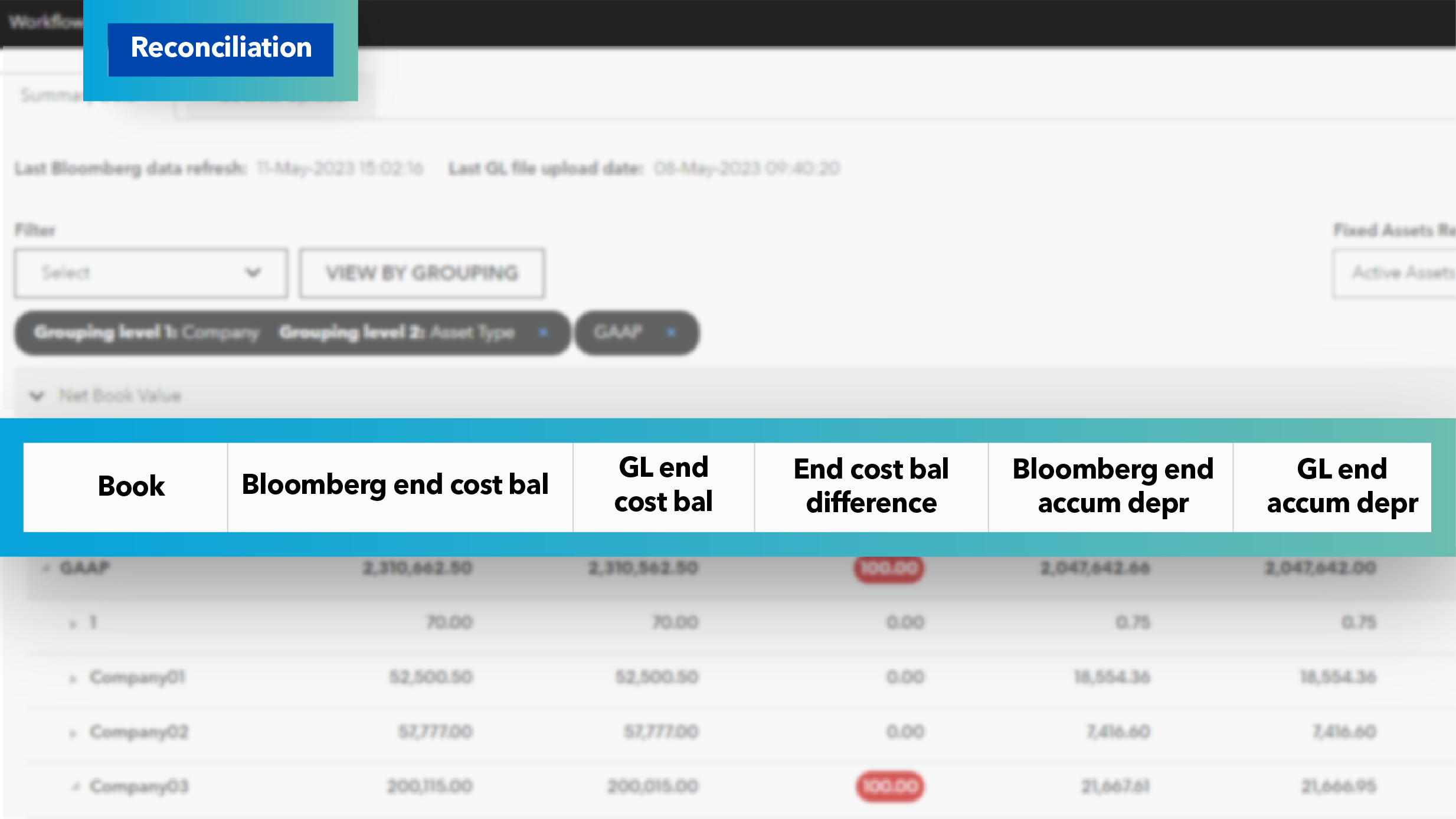

Eliminate the painful process of manually inputting, reconciling, and reporting data. Save time by automating fixed assets workflows from beginning to end with ERP integration.

Access the most accurate and expansive depreciation features, including bonus calculations and complex, nonconforming state capabilities. Project future-year impact while maintaining previously reported numbers.

As your business grows, your asset transactions inevitably become more complex. Bloomberg Tax Fixed Assets manages increased data complexities and prepares you to handle new challenges.

Leverage a full suite of standard and custom reports.

Unlock automation and integration at every step of your tax workflow.

Get a firsthand look at how our fixed assets solution will transform your work and address your specific needs.

Bloomberg Tax experts will make sure your experience is nothing short of excellent. Whether that’s ensuring a smooth implementation, helping convert data, or integrating with your tax compliance and accounting systems, we’ll make it simple.

Gain efficiencies and save money with a depreciation software that automates time-consuming calculations.

See how investing in automation technology helped Petco save time and gain peace of mind with a streamlined process that reduced manual data manipulation.

In a 2023 Bloomberg Tax survey, customers shared why they rely on our software to simplify how they manage fixed assets.

say they can respond to change more quickly and have more time for strategic activities.

say Bloomberg Tax Fixed Assets shortened their organization’s closing period.

of users agree that Bloomberg Tax Fixed Assets reduced the time it takes to make changes to an asset’s life while preserving historical calculations.

of customers said that having automatic tax law updates has been extremely useful.

“Having automatic updates allows us to focus on other things. Once we become aware of any changes, we know that it will be updated in the platform, and we will not have to worry about making any adjustments immediately. The platform does the calculation, and makes all future changes.”

Tax Manager

Cronimet Corporation

“We have used this product for decades as it is the most comprehensive and easy-to-use fixed asset software on the market. We can always count on timely product updates and 100% accurate calculations. It is our go-to product to manage our exhaustive list of fixed assets from acquisition to disposal and everything in between.”

CFO

Pam Transport

“Bloomberg Tax Fixed Assets allows my organization to efficiently complete all monthly, quarterly, and annual fixed asset tasks and federal and state tax filings … If my organization’s fixed asset related tasks were outsourced I would anticipate $50k+ in spend required.”

Senior Tax Manager

Public Corporation