Michael G. Branson Edited by

Michael G. Branson Edited by  Cliff Auerswald 16 comments

Cliff Auerswald 16 commentsBy  Michael G. Branson Edited by

Michael G. Branson Edited by  Cliff Auerswald 16 comments

Cliff Auerswald 16 comments

All Reverse Mortgage flawlessly handled my reverse mortgage purchase, providing clear explanations and great professionalism. They promptly answered my questions and quickly returned calls. I highly recommend them to friends and family. -John P.(BBB)

Welcome to our guide on Purchase Reverse Mortgages! In this article, we will explain how you can buy a new home with a special kind of reverse mortgage, making it easier for you to transition to a new living situation as you age. Whether you are considering downsizing, moving to a more accessible home, or relocating closer to family, this guide is for you.

We will cover the essentials – from the benefits of a Reverse Mortgage Purchase to how the Home Equity Conversion Mortgage (HECM) for Purchase program works – to help you understand if this option is right for you.

The HECM for Purchase is the most common reverse mortgage used to buy new homes. Applying for and qualifying for a HECM for Purchase follows the same steps as applying for any HECM loan.

Here are the main requirements:

After getting a HECM for Purchase, borrowers must:

The main difference between using a reverse mortgage to purchase a home and getting a reverse mortgage later is that the purchase is all done in one transaction, which means there are no duplicate fees.

For a Reverse Mortgage Purchase, the borrower needs to cover the down payment for the new home, which includes the required mortgage insurance . This may cost more than a typical conventional home mortgage but is still less expensive than buying a home and then getting a reverse mortgage later.

If you’re considering a reverse mortgage, a single Reverse Mortgage Purchase is often a better option than buying a home and refinancing with a reverse mortgage later.

A certificate of occupancy must be in place for new construction before completing a HECM for purchase transaction. Most property types can be purchased with a reverse mortgage, with a few exceptions.

Certain types of manufactured homes may also be ineligible for reverse mortgage financing, especially those built before 1976. HUD sets minimum standards for manufactured homes, and any properties that do not meet these standards are not eligible for a reverse purchase mortgage.

With a reverse mortgage for purchase, the borrower must cover the down payment for the new home. While this down payment is higher than for most other types of financing, there are no required monthly payments afterward.

Many borrowers use the equity from selling their current home to make the down payment on the new home. If this isn’t enough, the borrower may need to use savings or other sources. If the sale of the old home doesn’t cover the down payment for the new home, the borrower will need to provide the difference in cash.

FHA allows some sources, such as family gifts from those who do not have a stake in the transaction, to help with the down payment. If you plan to use gift funds, discuss this with your lender to ensure you meet the requirements for gift fund verification and eligibility.

The down payment requirement depends on:

Typically, the down payment for a HECM for Purchase is between 45-70% of the purchase price. The table below provides examples of down payment requirements for various home prices and borrower ages.

| Age | % Down | $200,000 | $400,000 | $600,000 | $800,000 | $1,00,0000 |

|---|---|---|---|---|---|---|

| 62 | 67.2% | $134,400 | $268,800 | $403,200 | $537,600 | $672,000 |

| 65 | 65.1% | $130,200 | $260,400 | $390,600 | $520,800 | $651,000 |

| 70 | 61.4% | $122,800 | $245,600 | $368,400 | $491,200 | $614,000 |

| 75 | 58.5% | $117,000 | $234,000 | $351,000 | $468,000 | $585,000 |

| 80 | 54.1% | $108,200 | $216,400 | $324,600 | $432,800 | $541,000 |

| 85 | 47.9% | $95,800 | $163,600 | $287,400 | $383,200 | $479,900 |

| 90 | 40.9% | $81,800 | $163,600 | $245,400 | $327,200 | $400,900 |

Please note that this is not a lending offer. The down payment figures provided are estimates, inclusive of the majority of essential closing costs, such as a 2% upfront mortgage insurance fee and third-party closing costs. These estimates are based on an interest rate of 6.93%, which includes an expected rate of 6.10% and an adjustable CMT margin of 1.625%, accurate as of December 4, 2023.

Here are common sources for your down payment:

The most common ways to meet the down payment requirement are proceeds from the sale of your previous home and savings. The Federal Housing Administration (FHA), which insures the loan, accepts various funding sources.

Acceptable sources for financing the down payment include:

All funds must be verified. Gifts from anyone involved in the transaction are not acceptable. Other less common funding sources, such as collateralized loans, savings bonds, and employer assistance programs, can also be used.

The following sources are not acceptable for your down payment:

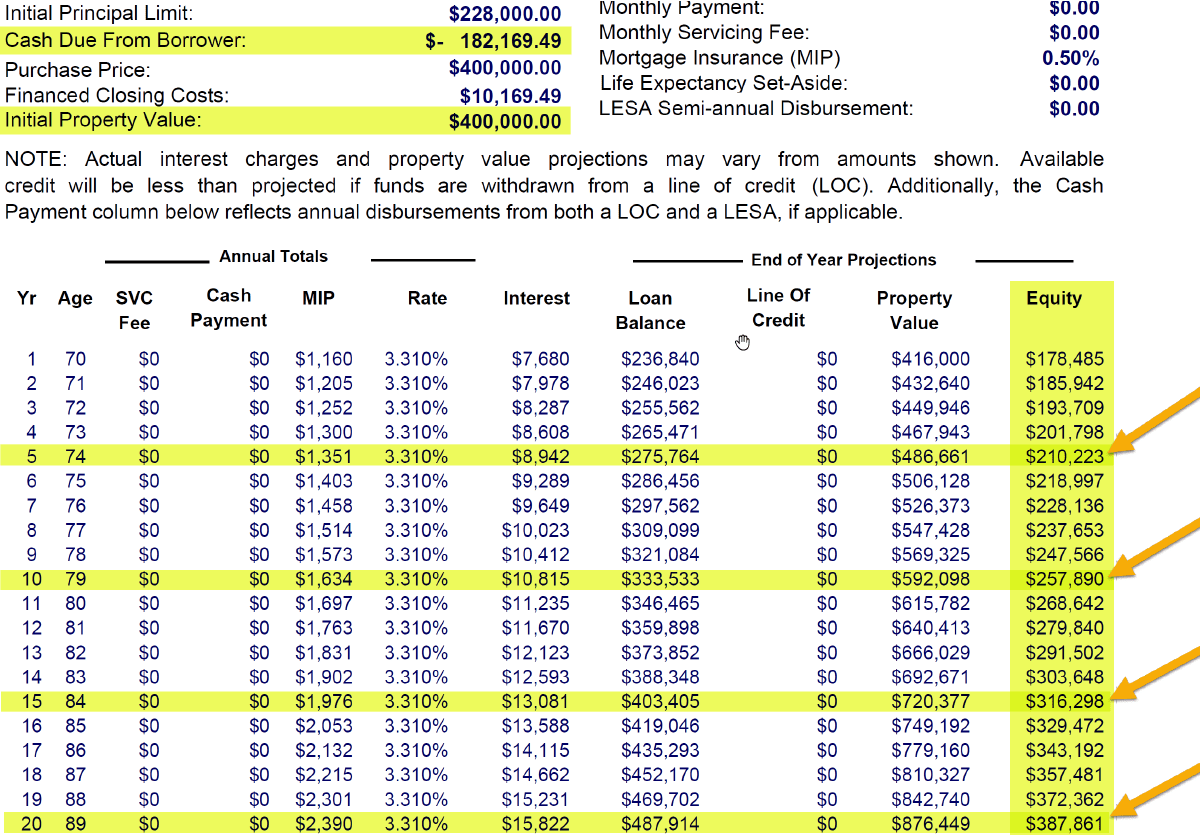

Let’s look at an example using a 70-year-old borrower who uses a reverse mortgage to buy a $400,000 home. The required down payment is $182,000, which is approximately 45% of the purchase price.

Predicting future interest rates or how much your home will appreciate over time is difficult. For this example, we’ll use a 4% annual appreciation rate for the home. The interest is calculated using an “expected rate” based on a 10-year index rather than the lower initial index rate.

While many properties appreciate more than 4% annually, 4% is a conservative estimate. You can adjust this based on your own expectations for your home’s appreciation.

The down payment covers all upfront mortgage insurance premiums and third-party closing costs. Based on the assumptions mentioned, the borrower would have $210,000 in home equity after five years of making no mortgage payments. After ten years, this amount would increase to $257,000.

If the borrower later decides to move into an assisted care facility, the loan becomes due. The borrower or their family can sell the home. Any equity above the outstanding loan balance belongs to the borrower and their heirs. They can:

The remaining equity depends on the home’s future appreciation, interest rates, the amount and timeliness of reverse mortgage funds drawn (which are 100% at inception for a purchase), and whether the borrower makes any early voluntary repayments.

| 2024 Lending Limit | Fixed Rate | Adjustable Rate |

|---|---|---|

| $1,149,825 | 7.180% (8.700% APR) | 6.885% (2.125 Margin) |

| $4,000,000 | 10.125% (10.612% APR) | 11.385% (6.625 Margin) |

Example calculation using fixed rate:

7.18% + .50% Monthly MIP = 7.68% in total interest charges. Fixed Rate APR calculated assumes a $250,000 loan amount and includes .50% Mortgage Insurance and standard 3rd party closing costs.

The HECM purchase program can be an excellent option for those who want to move during retirement, as it allows them to do so without making monthly mortgage payments. However, like all loans, there are some pros and cons.

ProsWhen purchasing a home with a reverse mortgage, it’s important to consider the real estate agent’s experience with reverse mortgages. While your mortgage originator can assist with questions, working with a real estate agent familiar with reverse mortgage transactions can be beneficial.

These updates make buying a home easier under the HECM for Purchase program by allowing more financial support from various sources.

For More Information:

Yes. Reverse mortgages have been available for purchase transactions since 2008. The FHA implemented this to eliminate the need for borrowers to do two separate transactions when buying a new home.

A reverse mortgage for purchase works similarly to a standard reverse mortgage. The loan amount is calculated using the age of the youngest borrower/spouse and the interest rate. The borrower then brings in funds at closing to cover the difference.

The down payment required depends on the borrower’s eligibility as determined by the HECM purchase calculator. Factors include the age of the youngest borrower/spouse, the interest rate, and the HUD lending limit. Typically, a 62-year-old borrower may need a down payment of about 36% of the purchase price, while a 92-year-old may need about 65%.

Yes, the source of your down payment is important when it comes to a reverse mortgage for a home purchase. The down payment cannot be made with borrowed funds. You must show that the funds are either your own or come from a source that is acceptable to both the lender and HUD. Acceptable sources include savings, proceeds from the sale of a property, other owned assets, or a bona fide gift from a close family member. However, personal loans, credit card advances, or similar borrowed funds would not qualify.

If you sell the policy or withdraw funds available, show the terms of the sale or withdrawal and the receipt of funds through the deposit in your account. You cannot borrow against the policy for the down payment.

The appraisal must be at or above the sales price. HUD will use the lower of the purchase price or appraised value to determine the loan amount.

Yes, but the condominium project must be HUD-approved. There are also jumbo or proprietary programs for non-FHA-approved condos, but the HUD program is recommended for higher loan amounts and lower interest rates.

Yes, HUD allows up to four units in the reverse mortgage program if the property is owner-occupied.

To be eligible, you must occupy the property as your primary residence. If you move into an assisted living facility, the home will no longer qualify as your primary residence.

HUD is stricter on credit for the purchase program. If your credit issues were three years ago and your credit has been good since you might qualify with a strong letter of explanation. A lender must review your credit history first.

If your state permits a non-borrowing spouse arrangement for reverse mortgages, your spouse could be recognized as such from the start of the process. However, you must meet specific conditions, including attending mandatory counseling sessions and signing documents.

You can sell the home at any time without restrictions or penalties. If HUD incurs a loss due to early departure, you would be ineligible for another reverse mortgage until the loss is repaid.

After obtaining a reverse mortgage through a purchase, you can sell with no specific time restrictions or limitations as you are the homeowner, and there is never a prepayment penalty. If you decide to sell the home without causing any financial loss to HUD from the initial transaction, you retain eligibility for securing another reverse mortgage on a different property, should you choose to do so. However, if HUD incurs a loss due to an early departure on your part (which is unlikely if you sell the property shortly after purchasing it), you would be ineligible for another reverse mortgage until the loss from the first loan is fully repaid.

Yes, but the new home can only close once the new reverse mortgage lender has verified that the old loan is fully paid off. There may be a slight delay between the transactions.

Look for real estate professionals with experience in reverse mortgage transactions. Call a few real estate firms and ask if they have agents familiar with the program. Understanding HUD rules and requirements is crucial.

ARLO recommends these helpful resources:

Michael G. Branson CEO, All Reverse Mortgage, Inc. and moderator of ARLO™ has 45 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively.

Look no further. Michael G. Branson, our CEO, brings a wealth of knowledge directly to you. With a robust 45-year tenure in mortgage banking and 19 years dedicated solely to reverse mortgages, he's the expert you want on your side.

Post your question in the comments below and anticipate a personalized response from Mr. Branson himself, typically within one business day. He's here to illuminate all angles of reverse mortgages, ensuring you're equipped with the knowledge to make informed decisions. Take this opportunity to gain insights from a seasoned professional.

16 Comments on this Article| Sonya August 23rd, 2024 |

| Michael Branson August 23rd, 2024 |

HUD does not have a minimum credit score requirement for a reverse mortgage. Instead, they state that the borrower must demonstrate good overall credit and an excellent payment history on their property charges. Typically, this means you should not have any late payments in the last 24 months on your home mortgage, rent, taxes, insurance, or other property-related charges (such as HOA dues). Additionally, borrowers should generally have a strong history of paying their credit obligations on time.

HUD does allow lenders to make judgment calls in certain situations where the borrower has shown that they are back on track with all obligations and that the events leading to the temporary lapse in payment history were beyond their control. For example, loss of employment, death, or other circumstances outside the borrower's control can sometimes be explained. However, even in these cases, you would need to provide satisfactory documentation that clearly connects the events to the credit issues and shows that these concerns are now resolved.

HUD is generally more concerned with the borrower's credit habits when purchasing a new home than with a refinance transaction. However, that doesn't mean a well-documented event beyond your control would automatically disqualify you from purchasing with a reverse mortgage. The best approach is to be completely honest with your lender from the beginning about any credit issues you have. This allows them to have an underwriter review your credit issues, explanations, and documentation upfront. The last thing you want is to make an offer on a home only to have an issue arise later that could have been addressed earlier.

| Marilyn March 17th, 2024 |

I am 71 (as of November 2023) and am thinking about buying a condo or a single family home with a reverse mortgage purchase. The purchase price will be approximately $500,000. How much down payment would I need to come up with?

So once I make that down payment, is that all the money I have to come up with and never HAVE to make a monthly payment?

Also how do I know which condos qualify for reverse mortgages?At present I have 2 condos that have no mortgages (together totaling equity about $400,000. Which would you recommend -sell one or both condos and use for down payment OR keep condos for rental income and/or sell just one condo and try to come up with rest of down payment?

If I use money from sale of condo, would I need to get a bridge loan to do the reverse mortgage purchase?

| Michael Branson March 19th, 2024 |

The amount needed would depend on closing costs in your area and interest rates at the time. I encourage you to contact us so that we can go over the programs and numbers. If you are not close to being ready and are just "testing the waters," you can always go to our website as well, at https://reverse.mortgage/purchase-calculator, and get a quote for your circumstances with accurate costs for your area if you are sure to include the zip code for the property you are considering.

Once you make the down payment, you never need to make a monthly mortgage payment. However, you do need to pay your taxes, insurance, and any property charges (such as HOA dues for a condo). That would also include any maintenance on the home. After all, you own the home, and if it appreciates, the increase in value is yours as well.

If you are considering a condominium. The project must be approved by HUD. You can go to the HUD website at https://entp.hud.gov/idapp/html/condlook.cfm to look up a prospective project to see if it is on HUD's approved list. The easiest way I've found is to go to the first page, input the zip code where you are looking, and hit enter. That will give you a list of all the projects HUD has reviewed in that zip code. Find your project as they are listed in alphabetical order by name.

Remember to check them all carefully by name and address, as some are listed by the name of the project and some by the name of the Homeowner's Association, depending on how they were submitted. If you do not see your project, it has not been submitted and HUD will not insure a loan in the project until after they receive a package of everything they need and determine that the risk is acceptable. This is a bad property for a reverse mortgage purchase as there is no way to know that a project approval can be done in time to complete your purchase transaction or that the project will even meet HUD guidelines and you will have a deposit at risk if you extend beyond the timeframe, you must cancel and still receive your deposit back which is usually just 17 days.

Remember, many projects are rejected outright by HUD or withdrawn because they do not meet HUD requirements, and you do not want to find this out after you have exceeded your timeframe to cancel your offer and receive your deposit back unless you are prepared to complete the purchase with other funds or financing. Be sure to look at the status of the project in the third column from the right and that the project's status is "Approved". Some buyers mistakenly think that just because the project is on the list, it is clear to proceed, but if the project is canceled, withdrawn, rejected, or expired, HUD will not insure a loan for that project at that time.

Just because a condo project qualified in the past does not mean it will qualify at the time you apply. The lender still has to gather specific information to determine whether the project qualifies. Too many rentals, a lawsuit against the HOA, or a sudden drop in reserves against losses are just some of the reasons that the project may no longer be eligible for the FHA insurance/HUD program.

I cannot advise you on your finances, so you can only decide if it is best for you to sell a property or keep it for rent, etc., but I can tell you that you cannot use borrowed funds for the down payment. For this reason, the bridge loan is off the table. You can sell the other properties if you wish, and any funds you use for the down payment must be fully sourced (bank records if they were in an account, closing statements if from the sale of property, etc.). Your loan officer can discuss options with you and run different scenarios based on the down payment you would need for different properties.

| Roberta E. August 10th, 2021 |