Year after year, change is inevitable. But it’s hard to keep track of every rule change, every year. As a requirement, all employers under the Affordable Care Act must report their IRS health benefits statements. Luckily for you, to give you peace of mind, our ACA compliance software allows you to stay ahead of the game with compliance that anticipates. At Viventium, our goal is simple: help you simplify reporting and avoid potential risks or costly penalties.

The Top Five Things Your ACA Compliant Payroll Software Will Do

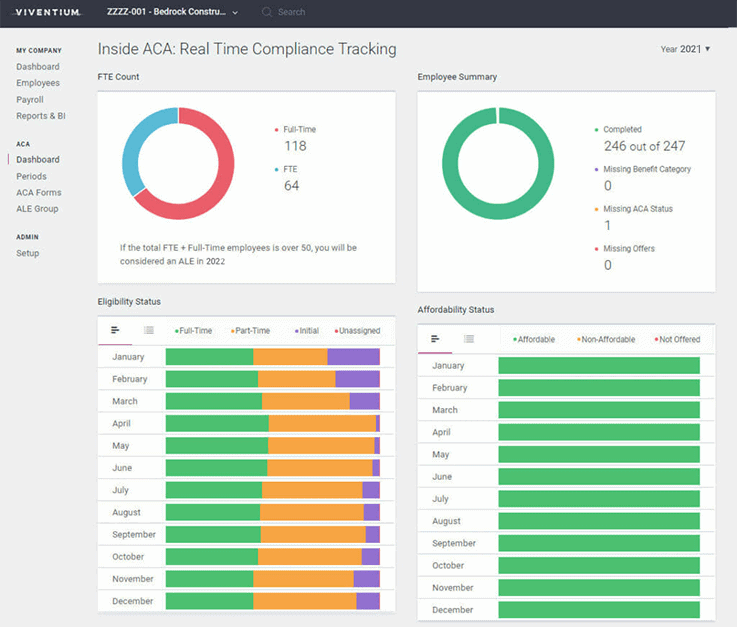

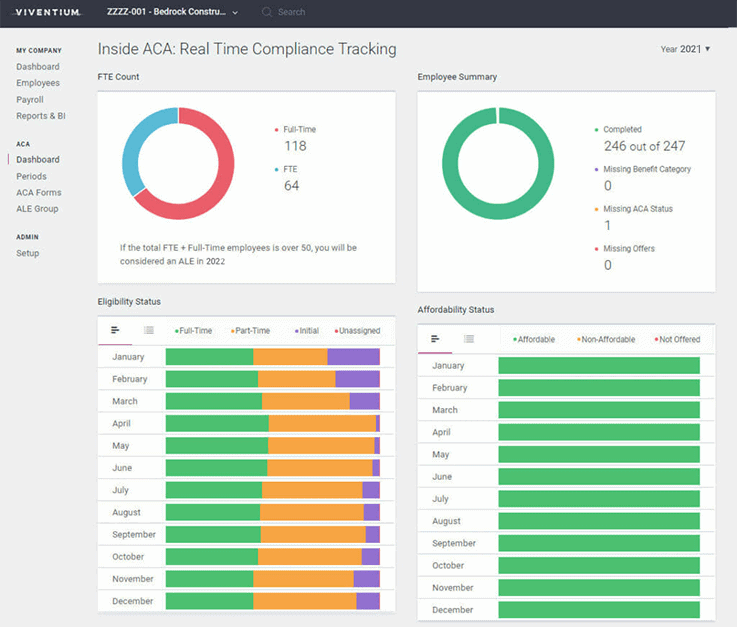

| Ensure your compliance at all times with a quick glance at the dashboard

| Check on your ALE status with this count of full-time equivalent employees

| Choose a visual bar graph or a numerical breakdown – whichever way you want to see your data

| Get real-time updates on full-time and part-time statuses of your employees

| Check our automatically generated list of your employees who might have changes to their status

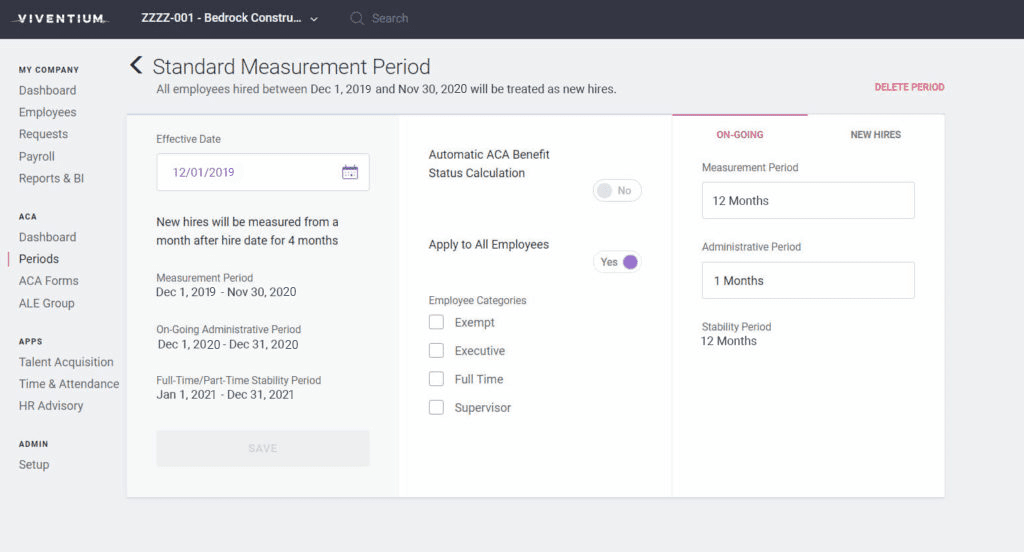

| Make changes manually, or let our smart system change your employee’s status for you

| Click on a widget to drill down into the data behind the visuals

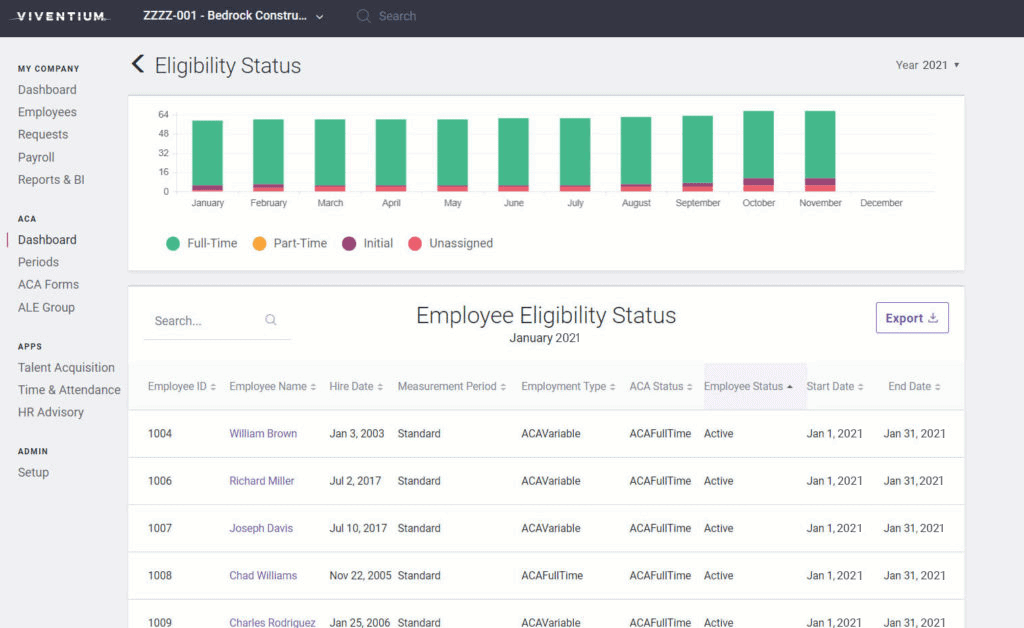

| Get even more details by clicking on each month

| See exactly which employees are behind the numbers and access their profiles

The lookback period to determine ALE status for 2015 can be anywhere between 6-12 consecutive months in 2014.

Employers with 100 or more full-time and full-time equivalent employees must offer health insurance to full-time employees.

ALEs must offer coverage to the employee but not dependents if dependents had not been previously offered coverage and the employer takes steps in 2015 towards offering dependent coverage.

ALEs must offer coverage to at least 70% of full-time employees in order to avoid the 4980H(a) sledgehammer penalty.

ALEs subject to the 4980H(a) penalty can disregard their first 80 full-time employees when calculating the penalty.

The amount of the 4980H(a) penalty is $2,080 per employee per year.

The amount of the 4980H(b) penalty is $3,120 per employee per year.

The 2015 Affordability Safe Harbor rate is 9.56%.

The lookback period to determine ALE status for 2024 and all future years is the full 12 months of the prior year.

Employers with 50 or more full-time and full-time equivalent employees must offer health insurance to full-time employees.

ALEs must offer coverage to the employee and their dependents up to age 26.

ALEs must offer coverage to at least 95% of full-time employees in order to avoid the 4980H(a) sledgehammer penalty.

ALEs subject to the 4980H(a) sledgehammer penalty can disregard their first 30 full-time employees when calculating the penalty.

The amount of the 4980H(a) penalty is $2,970 per employee per year.

The amount of the 4980H(b) penalty is $4,460 per employee per year.

In 2017, a conditional offer of insurance to a spouse must be reported separately.

The 2024 Affordability Safe Harbor rate is 8.39%

ICHRA offers of coverage reported on 1095-C.

Viventium is dedicated to keeping you informed of the latest payroll developments and assisting you with understanding the ever-increasing

government regulations. This information is not intended as tax or legal advice. We encourage our readers to consult their tax and law advisors.

Viventium was instrumental in helping my company become ACA compliant this past year. After I listened to one of Viventium’s webinars on ACA compliance and reporting requirements, I realized we weren’t doing enough. Viventium’s extremely helpful and responsive service alleviated a huge stress from my shoulders.

ASHER BRUCKNER LUCILLE ROBERTS HEALTH CLUBS![]()

For the year 2024, employers with 50 or more full-time employees or equivalents must offer health coverage to full-time employees and file Forms 1094-C and 1095-C with the IRS. Filings are due to the IRS in the first quarter of 2025, and a copy of the 1095-C must be distributed to each employee by March 3, 2025.

Employers who fail to offer health coverage and file Forms 1094-C and 1095-C may be subject to IRS penalties.

State health care reporting is on the rise as an increasing number of states require an employer to report their ACA information on the state level.

Relax. We’re on top of it, and if you are on our service, we’ve got you covered with the latest ACA requirements. We’ll keep you informed on the latest state health care reporting requirements and how you can maintain compliance.

To determine ALE status during the current year, employers use a lookback period during the prior year. If an employer has on average 50 or more full-time employees, including full-time equivalents, during the 2023 lookback period, the employer is an ALE for 2024.

Learn more about the Affordable Care Act by visiting our ACA FAQ page.

Viventium’s ACA reporting software helps you stay compliant by delivering live ACA data throughout 2024. At the beginning of 2025, Viventium will prepare and file Forms 1094-C and 1095-C on your behalf.

Our software calculates full-time and full-time equivalents to determine applicable large employer (ALE) status

Provides a preview of Forms 1094-C and 1095-C to review and approve before production

Alerts you to any missing or unaffordable offers

Calculates and tracks full-time or part-time status of each employee including variable employees to determine who must be offered health coverage

Tracks offers of coverage and affordability on a month-by-month basis

Produces Form 1095-C employee copies and e-files Forms 1094-C and 1095-C with the IRS

Viventium Software Inc. is a SaaS-based human capital management solution that provides a remarkable user experience and award- winning software. Viventium provides flexible software and expert guidance so clients can be sure their payroll is done right.

Viventium offers specialized solutions in the health services markets which include home care agencies and skilled nursing facilities. Viventium Software supports all fifty of the United States with payroll and HR solutions.

Relax – you’re with Viventium.

©2024 Viventium Software, Inc. All rights reserved. | Privacy Policy | Terms & Conditions | Legal |

Licenses: Viventium HCM LLC NMLS ID: 2094503

By filling out this form, you submit your information to Viventium, who will use it to communicate with you regarding updates and other services.

By filling out this form, you submit your information to Viventium, who will use it to communicate with you regarding updates and other services.

Overtime, oh, it’s a complicated game, Different rules in every state, it’s never the same, Multiply by 1.5, but there’s more to see, In this overtime equation, it’s not that easy, you see.

VERSE 1

In the world of work, there’s a tale to be told, About overtime hours, and the payroll gold, A consistent paycheck, that’s the worker’s dream, But when it comes to overtime, it’s not as easy as it seems.

PRE-CHORUS

Oh, Susie worked hard in San Francisco town, But the rules around overtime, they had her feeling down, 42 hours this week, she gave her all, Now it’s time to calculate, let the numbers fall.

CHORUS

Overtime, oh, it’s a complicated game, Different rules in every state, it’s never the same, Multiply by 1.5, but there’s more to see, In this overtime equation, it’s not that easy, you see.

VERSE 2

Exempt or non-exempt, the title they hold, Where they work, where you’re based, it’s all in the fold, California or New York, the laws they diverge, For payroll admins, it’s a never-ending surge.

PRE-CHORUS

Oh, the DOL’s website, a labyrinth to explore, State regulations galore, it’s quite a chore, Staying compliant, it’s a tricky art, Missing out on requirements can break your heart.

CHORUS

Overtime, oh, it’s a complicated game, Different rules in every state, it’s never the same, Multiply by 1.5, but there’s more to see, In this overtime equation, it’s not that easy, you see.

BRIDGE

But here’s a method that can save the day, A payroll software, to keep errors at bay, Input the info right, integrate with ease, No more manual labor, no more overtime fees.

VERSE 3

Back to Susie’s story, she’s owed her due, According to FLSA, it seems we have a clue, $860 on the table, that’s what we’d say, But California’s got its rules, changing the way.

PRE-CHORUS

Oh, California says, hours past eight, Are overtime-eligible, don’t underestimate, Now Susie’s owed $900, that’s the decree, In this overtime puzzle, you gotta set it free.

CHORUS

Overtime, oh, it’s a complicated game, Different rules in every state, it’s never the same, Multiply by 1.5, but there’s more to see, In this overtime equation, it’s not that easy, you see.

OUTRO

So when it’s overtime, and the rules entwine, Choose a payroll software, let it all align, Viventium’s the name, we’ve got the key, To make overtime calculations a breeze, you’ll see.

ENDING

Don’t overwork yourself, don’t you fret, With Viventium by your side, it’s a safe bet, Relax, you’re with us, in this overtime fight, With the right tools in hand, everything’s gonna be alright.

Take back time, like a winding clock, Retroactive pay, mending every block. Calculate the hours, with precision and grace, In the world of care, in this payroll space.

VERSE 1

In the world of care, where time slips away, Caregivers dedicate, every single day. But when the hours are missed, in the daily race, Retroactive pay, steps up to embrace.

PRE-CHORUS

A caregiver tired, at the week’s end, Forgot to log hours, a mistake to mend. Admins face the challenge, calculations to make, To set it right, for the caregiver’s sake.

CHORUS

Take back time, like a winding clock, Retroactive pay, mending every block. Calculate the hours, with precision and grace, In the world of care, in this payroll space.

VERSE 2

Manual calculations, prone to a flaw, Dealing with shifts, odd hours, and the law. As your business grows, the cost takes flight, Automated solutions, shining bright.

PRE-CHORUS

Compliance is key, with FLSA’s might, Calculate and compensate, get it right. Avoid the audit’s gaze, fines and the cost, Retroactive pay, no longer lost.

CHORUS

Take back time, like a winding clock, Retroactive pay, mending every block. Calculate the hours, with precision and grace, In the world of care, in this payroll space.

BRIDGE

Employee satisfaction, a crucial part, Resolve mistakes, a work of heart. Relationships flourish, in pay’s embrace, A payroll software, creating a trace.

VERSE 3

Star caregivers, valued and strong, Retention and recruiting, where they belong. Automated solution, a total pay dance, Establish your business, a work-life romance.

PRE-CHORUS

A self-winding watch, Viventium’s grace, Optimizing payroll, in every case. No more struggles, in the payroll game, In it with you, time and time again.

CHORUS

Take back time, like a winding clock, Retroactive pay, mending every block. Calculate the hours, with precision and grace, In the world of care, in this payroll space.

OUTRO

As your business grows, in the hustle and fight, Viventium by your side, making it right. No more worries, in the payroll chain, In it with you, time and time again.

Geo Tax, oh Geo Tax, our savior in the night, Guiding us through tax laws, shining a bright light. No more payroll worries, no more sleepless nights, With Viventium’s help, we’ll be alright.

VERSE 1

In the world of business, we all aim to thrive, Year after year, our dreams taking flight. But as we soar higher, we start to see, More money, more problems, just like B.I.G. Outgrowing our shell, it’s an exciting phase, But it brings with it some challenging days. Solutions we had, now show their flaws, As we push the boundaries, breaking through the walls.

CHORUS

Geo Tax, oh Geo Tax, our savior in the night, Guiding us through tax laws, shining a bright light. No more payroll worries, no more sleepless nights, With Viventium’s help, we’ll be alright.

VERSE 2

Employees across states, in different localities, Tax laws aplenty, creating complexities. Our old software’s limits, we’ve begun to see, Scaling up our business, we need to break free. Calculating pay and taxes, where it all begins, Errors in this process, lead to countless sins. Employees rely on us, trust in our might, To withhold what’s needed, get it just right.

CHORUS

Geo Tax, oh Geo Tax, our savior in the night, Guiding us through tax laws, shining a bright light. No more payroll worries, no more sleepless nights, With Viventium’s help, we’ll be alright.

BRIDGE

Taxes, they’re not simple, that’s for sure, A world of complexity, there’s always more. But Viventium stands with us, in this fight, Geo Tax, our ally, making everything right.

VERSE 3

CPAs may struggle, and admins too, Keeping up with taxes, what can they do? The rules keep changing, it’s hard to keep pace, But Viventium’s here, in this challenging space.

CHORUS

Geo Tax, oh Geo Tax, our savior in the night, Guiding us through tax laws, shining a bright light. No more payroll worries, no more sleepless nights, With Viventium’s help, we’ll be alright.

OUTRO

So relax, dear business, and set your mind free, With Geo Tax on our side, we’re the best that we can be. Viventium’s got us, in this tax-filled fight, No more worries, no more sleepless nights.

REPEAT CHORUS

Geo Tax, oh Geo Tax, our savior in the night, Guiding us through tax laws, shining a bright light. No more payroll worries, no more sleepless nights, With Viventium’s help, we’ll be alright.